Receiver of Taxes

The Tax Receiver’s Office is responsible for collection of taxes for over 14,000 parcels. In addition, the Tax Receiver also collects the water usage bills on behalf of the Town of Queensbury Water Department. Tax collection procedures are defined in Real Property Tax Law. Water collection duties and procedures are defined in Town Law.

***IMPORTANT NOTICE: If you use your bill-pay through your financial institution, a third-party processes your transaction. Such transactions are often mailed in bulk without U.S. Postage and therefore may not arrive at the Town of Queensbury timely and as scheduled. If these transactions/payments arrive at the Town after the due date, the Town must adhere to New York State Real Property Tax Law Section 925 and penalties will be added. Furthermore, no Town employee nor Elected Official can waive the penalty.

***All CHECKS must be written in BLUE or BLACK INK only***

Payment Options in addition to paying in person at the window:

- Mail in your payment Make your check payable to “Caroline Barber, Receiver of Taxes”. **CHECKS MUST BE WRITTEN IN BLUE OR BLACK INK ONLY** PLEASE enclose the entire bill when paying a tax bill, and the bottom portion of your bill when paying a utility bill. Mail payments to: Receiver of Taxes, 742 Bay Road, Queensbury, NY 12804.

- POSTMARKS: New York State Real Property Tax Laws govern tax collection. The United States Post Office Postmark date determines whether a payment is on time. Any payment postmarked on or before the due date will be considered timely. It is strongly suggested, if payment is mailed on the due date, to walk into the Post Office and have the date hand stamped by a Postal Employee.

- METERED MAIL: Tax payments delivered by the U.S. Postal Service after the due date that do not contain an official U.S. Post Office Postmark but rather a “postage meter” mark are not considered timely; the received date will be used at the date of the payment.

- Pay online If you wish to pay the Town and County taxes or the School taxes with a credit card or electronic check, you may do so by clicking on the link below “Pay your Taxes online with a debit or credit card“. We can only accept payments during our designated collection periods. There is a convenience fee of 2.45% on all online payments using a credit card, a flat convenience fee of $3.95 for payment with a Visa Debit, and a $1.75 convenience fee for an electronic check.

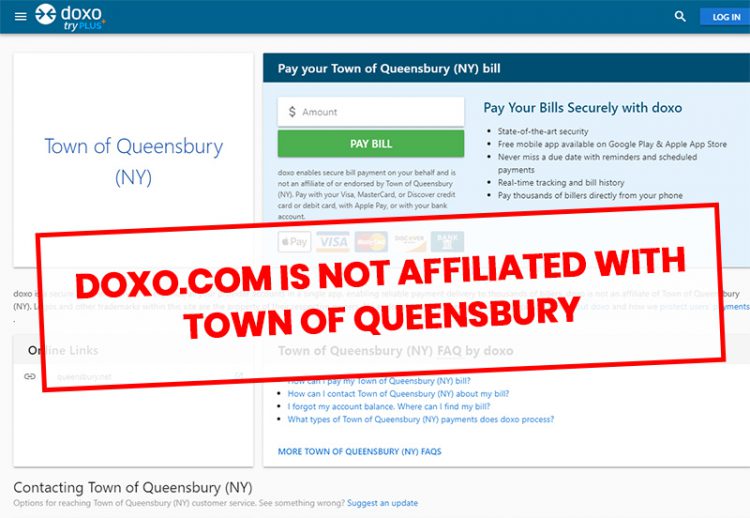

Resident Warning: Doxo.com

There is an online bill pay website that appears to be affiliated with the Town of Queensbury, but it is not. Doxo.com is not affiliated with the Town of Queensbury in any way.

To make sure you’re paying Town of Queensbury directly, visit our website at www.queensbury.net.

As always, if you receive suspicious phone calls or emails, from someone claiming to be a representative of the Town of Queensbury, requesting payment, please call us at 518-761-8234.

- **We now have the capability to accept Utility bill payments online as well.** You may do so by clicking on the link below “Pay your Utility bill online with a debit or credit card” There is a convenience fee of 2.45% on all online payments using a credit card (with a minimum fee of $1.75), and a flat convenience fee of $3.95 for payment with a Visa Debit card.

- Depository Box An additional option for payment is our after business hours secure depository drop box located outside the Town Office Building. You may place a check or money order ONLY – in a sealed envelope with your payment stub in this depository. Please note that any payments retrieved from the drop box before 8 AM each day will be credited to the previous business day.

- ACH Bank draft for Quarterly Utility Billing If you wish to enroll in automatic bank draft payments for your quarterly bills, you may do so by filling out the form provided below “Automatic Bank Draft Authorization Form“. Once this form is completed, it must be mailed in with a copy of a voided check from the account that you are authorizing the withdrawal. The Quarters in which regular billing occur are: February, May, August, and November. Bank draft paperwork MUST be received in our office by the 15th of the prior month to set up this service. Once enrolled, you will still receive a statement of your quarterly bill, and the balance due will be withdrawn from your banking institution of the 15th of each of those months (February, May, August, and November). It should be noted, if you decide to no longer use this service or if you sell your home, it is imperative to contact our office to submit a removal form and prevent further processing.

Copies of Tax Bills and/or Receipts

If you need a copy of a Town & County or School tax bill or receipt (which was paid at the Town of Queensbury), please click on the link below, “Search Your Tax History“. The search criteria defaults to our most current collection period. If you need details from a prior collection, click on the grey drop down arrow and select the correct one. Once you are on the collection period you need, only enter one of the search criteria to bring up your bill/receipt. Example: By Property Address, only enter the street # and street name (742 Bay). Do not enter Street, Road, Avenue, Court, etc. Example: By Owner Name, enter your Last Name and search. This will provide a list of all properties with that last name. Select which bill/receipt coincides with your property. Example: By Tax Map # , enter all characters of the number included (.) dots and (-) dashes. Example: By Bill #, this search can only be used if you know your current bill number. The bill number changes with every collection period and is a 4 or 5 digit number.

- Automatic Bank Draft Authorization Form (Word Doc)

- Automatic Bank Draft Authorization Form (PDF)

- Pay your Taxes online with a debit or credit card

- Search Your Tax History

- View utility payment history and consumption

- Pay your Utility bill online with a debit or credit card