Sewer Districts

Click on the sewer district below to view more information.

Greater Queensbury Consolidated Sanitary Sewer District consists of several areas previously known as Pershing, Ashley & Coolidge, Route 9, Queensbury Consolidated, Queensbury Technical Park, and West Queensbury Consolidated Sanitary Sewer Districts.

Broadacres area currently serves 32 single family residents.

- 3000 feet of sanitary mains

Northeast portion of the Town, including the Town’s business district of Queensbury, serving portions of Aviation Road, Quaker Road, Upper Glen Street, Bay Road, Ridge Road, Meadowbrook Road, and numerous other side streets.

- 25 miles of sanitary mains

- 16 grinder stations

- 3 main lift station

Northwest portion of the Town. Route 9 from Weeks Road to Route 149, includes portions of Weeks Road, Sweet Road, and Lawton Avenue.

- Constructed in 2004 and completed in 2005, serves mostly commercial area

- 50,000 feet of sanitary mains

- 2 main lift stations

Queensbury Technical Park is located off Dix Avenue. In addition, a portion of Luzerne Road between Media Drive and Western Avenue South.

- 15,000 feet of sanitary mains

Southern portion of the Town. West Queensbury area including exit 18 off of I-87. From the City of Glens Falls line at Western Avenue and Thomas Street to the area just past exit 18 on Corinth Road. Includes Carey Road Industrial Park and adjacent properties.

- 18,510 feet of sanitary mains

- Low-pressure force mains and gravity sewer

- Grinder pumps are privately owned

The Tax Rate is determined annually at a Public Hearing in September.

User Rate:

Residential: $5.50 per 1000 gallons

Commercial: $7.00 per 1000 gallons

Located in the Reservoir Park Development off Old Forge Road. Currently serving 25 single family residents. Sewage is treated by an on-site sub surface disposal system.

- 1800 feet of sanitary main

The User Rate is determined annually at a Public Hearing in September. This appears on the January Town & County Tax Bill.

Located in the South Queensbury area including portions of Queensbury Avenue and Dix Avenue, this serves the mostly industrial area and the Floyd Bennett Airport.

This district is made up of four municipalities, which include Queensbury, Warren County, Washington County, and Kingsbury.

- 20,000 feet of sanitary mains

- 2 main lift stations

The current design capacity of the main lift station is 103,680 gallons per day.

The Tax Rate is determined annually at a Public Hearing in September.

User Rate: $7.00 per 1000 gallons per quarter

What is a dedicated meter?

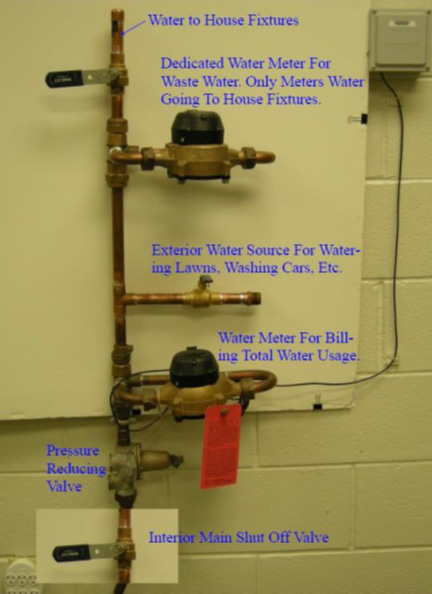

A dedicated meter is available to property owners located in a sanitary sewer district. A dedicated meter will not benefit those properties outside of a sanitary sewer district, connected to septic systems. The purpose of the dedicated meter is to charge for sewer on the water consumption that is flowing into the municipal sanitary sewer system and not charge sewer for the water used through a lawn irrigation system or garden hose spigot. The Town of Queensbury plumbs dedicated meters on the main service line, not on a lawn irrigation line. It is not a deduct meter.

The original water meter registers all water used inside and outside the home or business. The water charges are based on the original water meter usage.

The dedicated meter is plumbed downstream of the original water meter, lawn irrigation, and garden hose spigot tee connection. The dedicated meter registers all water used inside. The water used inside must be going down a drain into the sanitary sewer system therefore the sewer charges are based on the dedicated meter water usage.

The property owner is responsible for buying the dedicated meter from the Town of Queensbury Water Department. The meter man will install the dedicated meter. A pre-plumbing inspection is required before payment is accepted. Please call 518-793-8866, Monday – Friday, between 8:00 A.M. – 4:30 P.M. to arrange for a pre-plumbing inspection.